Property insurance is crucial for protecting your valuable assets. It covers various types of properties, ensuring financial safety in different situations.

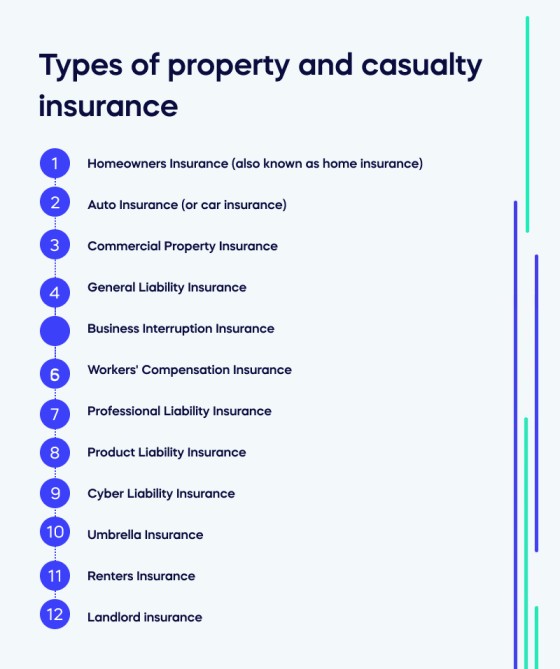

Understanding the different types of property insurance is essential for making informed decisions. Property insurance can cover homes, businesses, and personal belongings. Each type of insurance addresses specific risks and provides tailored protection. Knowing the differences can help you choose the right coverage for your needs.

In this blog post, we will explore the various types of property insurance available. By the end, you will have a clear understanding of which insurance best suits your property and lifestyle. Stay tuned to learn about the key features and benefits of each type.

Introduction To Property Insurance

Property insurance is essential for protecting your valuable assets. It covers various types of properties such as homes, businesses, and personal belongings. Understanding property insurance helps you make informed decisions. It ensures that your property is safe from unexpected events.

Importance Of Property Insurance

Property insurance is crucial for several reasons. First, it provides financial protection against damages. These damages can be from natural disasters, theft, or accidents. Without property insurance, you may face huge repair costs.

Second, property insurance offers peace of mind. Knowing your property is protected allows you to focus on other important tasks. Third, it ensures that you comply with legal requirements. Many mortgage lenders require property insurance. This requirement protects both you and the lender.

Basic Concepts

There are some basic concepts in property insurance you should know. Coverage types, deductibles, and premiums are key terms. Coverage types refer to what your insurance policy includes. This can be buildings, contents, or both.

Deductibles are the amount you pay before the insurance kicks in. A higher deductible usually means a lower premium. Premiums are the regular payments you make for the insurance. Understanding these concepts helps you choose the right policy.

Homeowners Insurance

Homeowners Insurance is a type of property insurance that provides financial protection against losses and damages to your home. It is essential for homeowners as it covers both the physical structure of the house and the belongings inside. Moreover, it offers liability coverage for accidents that might happen on the property.

Coverage Options

Homeowners Insurance typically offers several coverage options to suit your needs. Here are some common types:

- Dwelling Coverage: This covers damages to the house structure.

- Personal Property Coverage: This protects personal belongings inside the home.

- Liability Protection: This covers legal costs if someone gets injured on your property.

- Additional Living Expenses (ALE): This pays for temporary housing if your home is uninhabitable.

Common Exclusions

Homeowners Insurance does not cover everything. Here are some common exclusions:

- Flood Damage: Flood damage is usually not covered.

- Earthquake Damage: This is often excluded and requires separate insurance.

- Wear and Tear: Regular wear and tear are not covered.

- Intentional Damage: Damages caused intentionally are not covered.

Understanding these exclusions helps you avoid unexpected costs. It’s crucial to read and understand your policy details thoroughly.

Renters Insurance

Renters insurance is designed to protect tenants. It covers personal belongings and provides liability coverage. This type of insurance is essential for anyone renting a home or apartment.

Benefits For Renters

Renters insurance offers many benefits. It provides peace of mind. It ensures your belongings are protected from unexpected events.

- Affordable: Renters insurance is usually inexpensive.

- Liability Coverage: Protects you if someone gets hurt in your home.

- Personal Property Protection: Covers theft, fire, and other losses.

- Temporary Living Expenses: Covers costs if your rental becomes uninhabitable.

What It Covers

Renters insurance covers several important areas. Here is a breakdown:

| Coverage Type | Description |

|---|---|

| Personal Property | Covers your belongings, like furniture and electronics. |

| Liability | Protects you if someone is injured in your rental. |

| Medical Payments | Covers medical expenses if a guest is injured. |

| Additional Living Expenses | Pays for hotel bills and food if you cannot live in your rental. |

Renters insurance is a smart investment. It protects your personal items and offers liability coverage. Consider adding this valuable coverage today.

:max_bytes(150000):strip_icc()/building-and-property-coverage-form-FINAL-c0795f2e2b544252bfbdc4944d940e17.jpg)

Credit: www.investopedia.com

Condo Insurance

Condo insurance offers protection for your condo unit and belongings. It differs from homeowners insurance in several ways. Understanding these differences ensures you get the right coverage for your needs.

Differences From Homeowners Insurance

Condo insurance covers only the interior of your unit. Homeowners insurance covers the entire property and structure. The condo association’s master policy covers common areas. This includes hallways, roofs, and amenities. Therefore, condo owners need a policy that complements the master policy.

Homeowners insurance includes liability for the land and exterior. Condo insurance focuses on personal belongings and interior. The association handles the external structure. Thus, the scope of coverage is narrower for condo insurance.

Typical Coverage

Condo insurance usually covers personal property. This includes furniture, electronics, and clothing. It also covers interior walls, floors, and fixtures. If your condo gets damaged, your policy helps with repairs.

Loss of use coverage is another important feature. If your condo becomes uninhabitable, the policy covers living expenses. This ensures you have a place to stay.

Liability protection is also included. If someone gets injured in your unit, your policy covers medical expenses. It also covers legal costs if they sue you.

Understanding these aspects helps you choose the right condo insurance. Make sure to review your policy and know what is covered.

Landlord Insurance

Landlord insurance is a type of property insurance designed specifically for rental property owners. It offers protection beyond standard homeowner’s insurance, addressing the unique risks landlords face. This coverage is essential for property owners who rent out their homes, apartments, or other dwellings. Below are some key aspects of landlord insurance.

Protection For Property Owners

Landlord insurance provides comprehensive protection for property owners. This includes coverage for the physical structure of the rental property, such as the walls, roof, and foundation. It also extends to any permanent fixtures like cabinets and built-in appliances.

- Coverage for natural disasters

- Protection against vandalism

- Insurance for fire damage

Having this coverage ensures that property owners are not financially burdened by unexpected damages. It helps in maintaining the property’s value and ensures it remains a viable income source.

Liability Coverage

Liability coverage is another crucial component of landlord insurance. It protects landlords from legal and medical expenses if someone gets injured on their property. This could be a tenant, a guest, or even a contractor working on-site.

Key features of liability coverage include:

- Legal fees if sued by a tenant

- Medical expenses for injuries

- Compensation for lost wages

Liability coverage is essential to safeguard landlords from potential lawsuits. It provides peace of mind knowing that unexpected incidents won’t lead to financial ruin.

| Coverage Type | Description |

|---|---|

| Property Protection | Physical structure, fixtures, and appliances |

| Liability Coverage | Legal and medical expenses for injuries |

Flood Insurance

Flood insurance is a vital type of property insurance. It provides coverage for damages due to flooding. Floods can cause extensive damage. This makes flood insurance essential for many homeowners. Without it, repair costs can be overwhelming.

Why It’s Necessary

Floods are among the most common natural disasters. They can occur almost anywhere. Standard home insurance policies usually do not cover flood damage. This gap can leave homeowners vulnerable. Flood insurance fills this gap. It protects your investment and finances. It ensures you are not left with a huge bill after a flood.

Even areas not prone to floods can experience them. Heavy rains, storms, or broken dams can cause unexpected flooding. This makes flood insurance important for all homeowners. It provides peace of mind. It ensures you are prepared for the unexpected.

How It Works

Flood insurance works similarly to other insurance types. You pay a premium for coverage. If a flood damages your home, you file a claim. The insurance company assesses the damage. They then pay for repairs or replacement costs.

Coverage limits and premiums vary. They depend on your location and risk level. Higher-risk areas may have higher premiums. It is crucial to understand your policy. Know what is covered and what is not. This helps avoid surprises during a claim.

Flood insurance can cover building and contents. Building coverage includes the structure itself. Contents coverage includes personal belongings. Both types are important for full protection. Make sure to get adequate coverage for both.

Earthquake Insurance

Earthquake insurance is a type of property insurance that covers damage caused by seismic activity. This type of insurance is crucial for homeowners in areas prone to earthquakes. It helps to protect investments and provides peace of mind.

Regions At Risk

Some regions are more susceptible to earthquakes. The West Coast of the United States, especially California, is one such area. Japan is another region with frequent seismic activity. New Zealand and parts of Asia also face high risks. Understanding your region’s risk level is essential. This can help you decide if earthquake insurance is necessary.

Coverage Details

Earthquake insurance typically covers damage to the structure of your home. It also includes attached structures like garages. Personal belongings inside the home are often covered too. Policies can vary, so read the details carefully. Some policies may include additional living expenses. This helps if you need to live elsewhere while repairs are made. Deductibles for earthquake insurance can be higher than other types of insurance. This is due to the significant potential damage earthquakes can cause.

Credit: krapflegal.com

Commercial Property Insurance

Commercial Property Insurance is vital for any business. It protects physical assets from risks like theft, fire, and natural disasters. This insurance ensures your business can recover quickly from unexpected events.

Business Protection

Commercial Property Insurance safeguards various business assets. This includes buildings, equipment, furniture, and inventory. Protection extends to the physical structure and its contents. Coverage can also include outdoor signs, fencing, and landscaping.

Having this insurance means your business is prepared for unforeseen events. It minimizes financial losses and keeps operations running smoothly. Ensure your assets are covered to avoid costly disruptions.

Types Of Coverage

There are different types of coverage available under Commercial Property Insurance:

- Building Coverage: This covers the physical structure of your business.

- Business Personal Property: This includes items like furniture, computers, and inventory.

- Business Interruption Insurance: This helps cover lost income during a temporary closure.

- Equipment Breakdown Coverage: This covers repair or replacement costs for damaged equipment.

- Ordinance or Law Coverage: This helps with costs to meet updated building codes.

Consider what your business needs most. Choose coverage that best protects your assets.

| Type of Coverage | Description |

|---|---|

| Building Coverage | Protects the physical structure of your business. |

| Business Personal Property | Covers items like furniture, computers, and inventory. |

| Business Interruption Insurance | Helps cover lost income during temporary closure. |

| Equipment Breakdown Coverage | Covers repair or replacement costs for damaged equipment. |

| Ordinance or Law Coverage | Helps with costs to meet updated building codes. |

Selecting the right coverage is crucial. Assess your business’s needs and risks. Ensure you have the proper protection in place.

Tips For Choosing Property Insurance

Discover the various types of property insurance to find the right coverage. Consider options like homeowners, renters, and commercial property insurance. Each type offers specific protections for different needs.

Choosing the right property insurance involves many considerations. There are numerous types of property insurance available, and selecting the best one can be challenging. This section provides practical tips to help you make an informed decision.Assessing Your Needs

Start by evaluating what you need. Consider the type of property you own. Is it a home, rental property, or business property? Each type has different coverage needs. Think about the risks specific to your area. Floods, earthquakes, and other natural disasters can impact your decision. List your valuable items. Make sure high-value items like jewelry or electronics are covered. Understand the level of coverage you need. Some policies offer replacement cost coverage, while others provide actual cash value coverage. Know the difference.Comparing Policies

Once you understand your needs, compare different policies. Look at the coverage limits each policy offers. Higher limits provide more protection but may cost more. Pay attention to deductibles. A higher deductible can lower your premium, but you will pay more out of pocket if you file a claim. Examine the exclusions in each policy. Some policies exclude certain events or items. Make sure you know what is not covered. Check for additional coverage options. Some insurers offer add-ons like flood or earthquake insurance. These can provide extra protection if needed. Read customer reviews. See what other policyholders say about their experience. Customer service and claims handling are important. You want an insurer that is reliable and responsive. By following these tips, you can choose a property insurance policy that meets your needs and provides peace of mind.

Credit: www.walkme.com

Frequently Asked Questions

What Is Property Insurance?

Property insurance covers damage to property and possessions. It protects against risks like fire, theft, and natural disasters. It’s essential for homeowners and businesses.

What Does Property Insurance Cover?

Property insurance typically covers buildings, personal property, and liability. It may include damages from fire, theft, vandalism, and natural disasters. Coverage varies by policy.

Is Property Insurance Mandatory?

Property insurance is often mandatory for homeowners with mortgages. Lenders require it to protect their investment. For renters, it’s optional but highly recommended.

How Much Does Property Insurance Cost?

Property insurance costs vary based on location, property value, and coverage. Average costs range from $1,000 to $3,000 annually. Discounts may be available.

Conclusion

Choosing the right property insurance is essential for protecting your assets. Different types of coverage suit various needs. Homeowners, renters, and commercial property insurance each have unique benefits. Evaluate your specific requirements before making a decision. Consult with an insurance expert to ensure you get the best coverage.

This can save you from potential financial losses. Understand your policy details thoroughly. This knowledge empowers you to make the best choice. Ensure your property is well-protected and secure. Peace of mind comes with the right insurance. So, take the time to select wisely.

Your future self will thank you.